Webinar

Fund Finance webinar series: Financing the Fund Lifecycle | The end

Tuesday, 19 March 2024 (4 p.m. GMT)

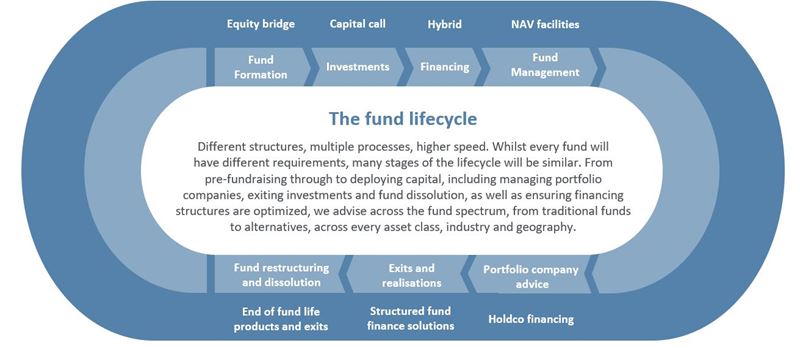

The fund finance market is complex and constantly evolving. Structuring deals to match financing needs requires a deep understanding of the relevant legal and commercial issues for both...