Hogan Lovells achieves record financial results for calendar year / financial year 2023

London, Washington, D.C., 13 February 2024 – Global law firm Hogan Lovells today released a summary of the firm’s financial results for FY 2023, announcing global revenue that was the highest in the firm’s history.

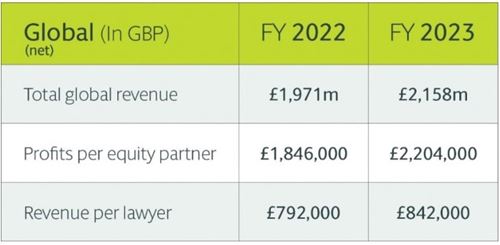

Global revenue increased by 10.3% from FY 2022 to FY 2023 as measured in US$ (9.5% as measured in GBP).

Key global figures:

- Across our regions, the Americas represented approximately 48% of total billings, EMEA 47%, and Asia-Pacific 5%.

- In terms of our three global practice groups, Corporate & Finance represented approximately 41% of total billings, Global Regulatory & Intellectual Property, Media and Technology (IPMT) 31%, and Disputes 28%.

According to Hogan Lovells CEO Miguel Zaldivar:

“We have reported another year of record revenue and profitability growth. We can attribute these outstanding results to a number of factors, including our laser focus on providing exceptional legal services to clients, often in their most complex and challenging matters, across multiple jurisdictions.

“We are a leading global law firm that is making a noticeable impact in the market—as one of only a few law firms with a truly integrated global offering. The culture qualities that define us represent a healthy balance between being ambitious and supportive. The last three years – 2021, 2022, and 2023 – have been the three top years of financial performance for our firm.

Our strengths across our practice groups and sectors

“Despite continued market challenges, we had a very strong year across our practice groups

and sectors.

“Our Corporate & Finance practice group, which experienced record growth in M&A, represented clients in marquee transactions including Life Storage in its US$12.7 billion

merger with Extra Space Storage, and Mercedes Benz Group AG in a joint venture to develop abranded network of high-powered electric vehicle chargers.

“Our Global Regulatory & IPMT group guided Kaiser Foundation Hospitals on its US$7 billion acquisition of Geisinger Health System and we represented LG Electronics in important patent litigation, securing a unanimous defense jury verdict.

“Our global disputes practice, recognized as one of the strongest in the world, represented Coinbase in the first cryptocurrency case ever heard at the Supreme Court, and the Eurasian Natural Resources Corporation in the successful conclusion of a 10-year case brought by the UK Serious Fraud Office.

“As a firm, we shine in our representation of clients in highly regulated sectors—including financial institutions, life sciences, technology, media and telecoms, automotive/mobility, and energy.

Investments in our firm

“We continue to invest in our firm through strategic growth, by nurturing and retaining our talent, and by strengthening our presence in important markets and key practices.

“Last year, we added more than 50 partners globally. We welcomed nearly 70 lawyers from Stroock & Stroock & Lavan in our New York, Washington, Miami, and Los Angeles offices. As one of Washington, D.C.’s largest law firms, we continue to attract top talent, including former D.C. Attorney General Karl Racine, who heads our State AG practice. We have added to our global Energy Transition team in Washington, London, Germany and Singapore.

Delivering on our DEI and Responsible Business commitments

We announced the promotion of 28 new partners and 59 new counsel in January this year. I am pleased to note that 43% of this year’s new partner cohort are women. In addition, 35% of our new partners, and 20% of new counsel, identify as racially or ethnically diverse, demonstrating our continued commitment to the recruitment, retention, and advancement of our diverse talent.

“One of the first major law firms to create a stand-alone pro bono practice, we are proud of the role we play in our communities. In 2023, the firm represented pro bono clients in some of the most high profile cases globally, including successfully arguing before the U.S. Supreme Court in the landmark voting rights case Moore v. Harper, and in the UK, advising Pacific Links Foundation which represents a number of the families of the Vietnamese people who died in a lorry after being illegally trafficked into the UK.”

We represented clients in major matters in 2023 that include:

Corporate & Finance

- Life Storage in its response to an unsolicited takeover proposal and subsequent US$12.7bn

friendly merger with Extra Space Storage, creating a US$47bn enterprise value combined

company. - Mercedes Benz Group AG on its joint venture with MN8 Energy to develop, own and

operate a Mercedes-Benz branded network of 2,500+ high-powered electric vehicle chargers

across the U.S. and Canada. - Marsh McLennan on the sale of Mercer’s U.S. health administration business and UK

pensions administration business to Bain Capital Insurance. - China Baowu Steel Group, the world’s largest steel maker, on its multibillion dollar

investment in the world class Simandou iron ore project in the Republic of Guinea, a

landmark project that reportedly stands as the largest mining and infrastructure project in

Africa. - Harbour Energy in its US$11.2bn acquisition of Wintershall Dea assets.

- The €4.4bn debt financing of the Baltic Power offshore wind project in Poland.

- Lloyd’s on its new lease of the iconic Lloyd’s Building, including a multi-million pound

package of energy efficiency works, securing its future occupation of the building on a

sustainable basis until 2035 and beyond. - The Republic of Ghana in groundbreaking, precedent-setting comprehensive domestic

debt exchanges. - Pantheon Ventures as lead investor in a US$2bn Wells Fargo Secondary Transaction.

- Verkor on its record financing of over €2bn, to launch high performance battery gigafactory

in Dunkirk (France) and accelerate future sustainable mobility.

Global Regulatory & Intellectual Property, Media, and Technology (IPMT)

- Kaiser Foundation Hospitals on its US$7bn acquisition of Geisinger Health System and launch of its major new nonprofit initiative, Risant Health.

- LG Electronics in a patent litigation dispute on behalf of our client and third-party Google as a mobile device technology supplier, securing a unanimous defense jury verdict for LG, finding no infringement and that all three asserted patents were invalid.

- Daiichi Sankyo in a transaction involving a total potential consideration of up to US$22bn to develop and commercialize a class of biopharmaceutical drugs that are designed as a targeted therapy for cancer.

- Inhance Technologies, the U.S.’s largest provider of post-mold fluorinated barrier packaging, in the defense of nationally-precedential litigation brought by the federal government under the Toxic Substances Control Act seeking to shut down eleven facilities, significantly disrupting supply chains, due to the unintended presence of

minute quantities of per- and polyfluoroalkyl substances in packaging. - The London Metal Exchange against judicial review and human rights claims by traders who sued over its decision to cancel nickel trades due to a crisis in the nickel markets.

- Ontario in several North American Free Trade Agreement, United States-Mexico- Canada Agreement, and U.S. Department of Commerce dispute proceedings involving

multiple aspects of the Softwood Lumber from Canada trade dispute, the largest ongoing trade litigation dispute between Canada and the U.S. (and historically the largest trade subsidy dispute in the world). - Rivada Space Networks in its major contracts, capital raising transactions and strategic matters, including a US$2.4bn procurement contract with Terran Orbital and a large procurement contract with SpaceX.

- UK Government on its successful defense of judicial review challenges to the sale of energy supplier, Bulb to Octopus.

Disputes

- Coinbase in the first cryptocurrency case ever heard at the Supreme Court, obtaining a

decision confirming a case is automatically stayed during the pendency of an

interlocutory appeal of a denial of a motion to compel arbitration. - Danco Laboratories in a case that reached the Supreme Court, after a Fifth Circuit

judge effectively revoked FDA approval for mifepristone, a drug commonly used in

abortion. - Bristol-Myers Squibb in a victory at the Hawaii Supreme Court, overturning a

US$1bn judgment against BMS in a nine-year battle involving whether the company

violated state law in the marketing of their drug, Plavix. - Blue Cross in a long-running case against the State of California, saving the insurer

US$4.3bn in retroactive taxes. - Eurasian Natural Resources Corporation (ENRC), in a case establishing bad

faith on the part of the UK Serious Fraud Office, which subsequently closed the 10-year

long criminal investigation into ENRC without bringing any charges. - PrivatBank in a US$2bn fraud case against the bank’s former shareholders Igor

Kolomoisky and Gennadiy Bogolyubov. The trial ended in November 2023; a judgment

is expected this year. - The University of Louisville in a victory against the NCAA’s enforcement arm, in the

aftermath of the widely covered indictments and convictions of Adidas employees for a

scheme to pay players and their families to attend universities affiliated with the sports

apparel company.

ESG

- Our ESG Practice Group comprises more than 500 lawyers in five subpractices that represent the pillars of ESG: Environmental, Energy Transition, Sustainable Finance & Investment, Social, and Governance & Corporate.

- International Finance Corporation on its investment in a US$250 million green bond issued by the Bank of the Philippine Islands.

- Helion agreement with Microsoft, the world’s first fusion power purchase agreement.

- Wildlife Trusts on their key partnership with Aviva. The Trusts will use donations of £38 million to establish rewilding sites in the west of England and Wales, as part of Aviva’s wider commitment to help tackle the interlinked nature and climate emergencies.

- Chubu Electric Power Co. Inc. on its acquisition of an equity participation in Eavor Erdwärme Geretsried GmbH via a share capital increase. Eavor Erdwärme Geretsried GmbH is engaged in the world's first geothermal power generation and district heat supply project utilizing the closed-loop geothermal technology by Eavor Technologies Inc.

- Infracapital Partners Greenfield Fund II (“IGP II”) in the introduction of KKR as an investor into Zenobē Energy Limited. The investment will accelerate the decarbonization of fleet transportation and maximizing the uptake of renewables.

Diversity, Equity & Inclusion (DEI) and Responsible Business

- Announced the promotion of 28 new partners and 59 new counsel in January

2024:

- 43% of this year’s new partner cohort are women.

- 35% of our new partners, and 20% of new counsel, identify as racially or ethnically diverse, demonstrating our commitment to the recruitment, retention, and advancement of our diverse talent.

- Achieved Mansfield Certification Plus in both the U.S. and UK in recognition of our work on DEI. It’s the fifth consecutive year the firm has been awarded this status in the U.S. and the second in the UK.

- WaterAid was announced as our global non-profit partner organization beginning in 2023. Our efforts are focused on goal 6 of the UN’s Sustainable Development Goals – to ensure availability and sustainable management of water and sanitation for all.

- Conducted an investigation with the leading human rights NGO, Equality Now, on current and prospective laws around the world that regulate gender-based violence in deepfake technology and doxing.

- Launched the Solicitor Apprenticeship Scheme in collaboration with the City of London Law Society Training Committee. The first cohort of solicitor apprentices will

join Hogan Lovells in September 2024.

Pro Bono

- Globally the firm engaged in a total of 156,000 hours of pro bono work in 2023.

- Represented Common Cause in the landmark voting rights case Moore v. Harper, in which the Supreme court rejected the so-called “independent state legislature theory” which would have essentially left state legislatures with the power to veto the results of federal elections.

- On behalf of two wrongfully convicted brothers, secured Fourth Circuit affirmance of a jury verdict we also had obtained for the brothers, who spent 31 years in prison for a murder they didn’t commit.

- Advising Pacific Links Foundation, which represent a number of families of 39 Vietnamese people who died in a lorry after being smuggled to the UK via Belgium in 2019. In November 2023 a Paris court ruled that a damages award should be made in favour of the represented victims, following similar rulings in London and Belgium.

- Secured a substantial financial award of compensation for a client under the Windrush Compensation Scheme.

- Royal British Legion – We are one of the only UK law firms to have a dedicated pro bono programme that supports veterans in War Pensions and Armed Forces

Competition Tribunals. We recently achieved an increase of 30% for a Royal British Legion disability assessment, which resulted in an additional annual financial benefit as well as eligibility for other allowances. - Through our dedicated social impact practice HL BaSE, we advised Black Seed, a venture capital seed fund dedicated to Black founders in the UK, on its £5m first closing. Through HL BaSE legal we have advised over 800 social enterprises across North America, Europe and Asia.