Consulting

New business seeking to understand the regulatory landscape? Established business navigating regulatory change and oversight? Identified an actual or potential regulatory issue? Or just want some assurance that you're meeting your regulatory requirements? From the first step of getting to grips with the compliance, risk and legal implications to planning and implementing any operational changes, we're here to help you.

End to End Service

We offer interpretation, planning, and implementation as an end to end service. You receive an efficient and effective solution that achieves your business and regulatory objectives at a lower cost than specialized consulting groups. All delivered under one roof, by deeply experienced specialists.

When regulatory requirements drive changes to business operations, we integrate and leverage technology and data driven solutions where required. You benefit from a seamless process provided by one firm, lowering the risk of project slippage and giving time back to your key stakeholders.

Our Consulting Team

Specialist team of operational and regulatory consultants, with a broad range of backgrounds. Our people have worked for Regulators, large consultancies and a wide range of financial services institutions. We work with you to understand the operational, risk and compliance needs of your business. Our unique blend of experience then gives us the knowledge and insight to provide innovative and tailored solutions, with support from our market leading legal practice, where required.

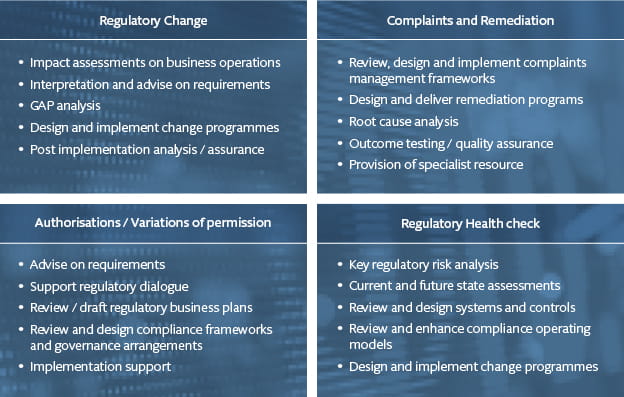

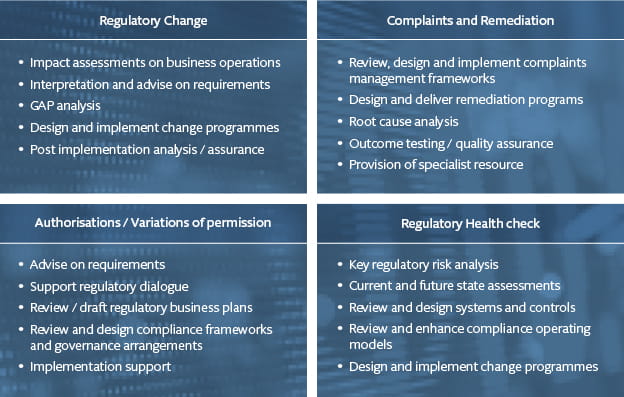

We're here to help you:

Learn more about how we work with our clients by visiting our areas of focus, with supporting case studies.